A Parting Gift: Bad Tax Policy

To increase tax revenues, the government enacted a policy effective January 1, 2023, assigning a fictitious wage of 48,000 florins per year to all company managing directors. At the time, the tax-free income threshold was 30,000 florins per year, meaning the additional 18,000 florins would be subject to wage tax. This measure was designed to ensure that company directors contributed a minimum amount of taxes to the state even if they did not receive an actual salary. The rationale was clear: to address potential loopholes and guarantee that managing directors paid their fair share.

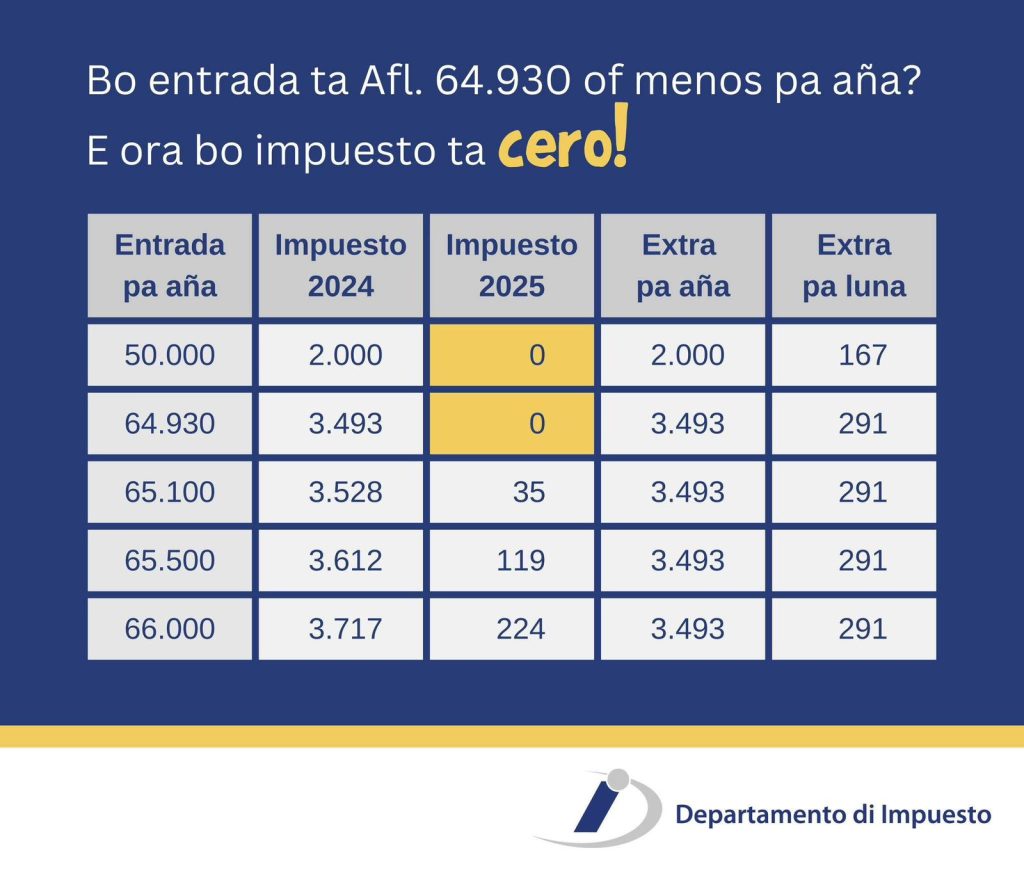

However, as of January 1, 2025, a post-election policy change has upended this framework. The government raised the tax-free income threshold to nearly 70,000 florins, which is politically motivated. It was a deliberate attempt to frustrate the incoming administration by removing a crucial tax income stream without implementing countermeasures to compensate for the loss. Whether intentional or not, this action undermines the 2023 measure, rendering the fictitious wage mechanism ineffective.

The Problem with Fictitious Wages

The 2023 policy was controversial from the start. By imposing a fixed, hypothetical wage on directors regardless of their actual earnings, the law created a one-size-fits-all solution that disregarded the financial realities of many businesses. While larger corporations might have absorbed the cost without issue, small and medium enterprises, whose directors often reinvest cashflow or profits into their companies, likely felt the pinch.

Still, the measure intended to expand the tax base and ensured directors paid at least a baseline wage tax amount. It also sent a message about fairness and accountability in the tax system.

The 2025 Policy Reversal

The new tax-free threshold of nearly 70,000 florins effectively nullifies the 2023 measure. Company directors, who were once deemed to earn 48,000 florins annually for tax purposes, now fall below the taxable income level. By raising the threshold ad hoc or without consultation or careful planning, the outgoing administration effectively removed a tax income stream that had bolstered state revenues. This lack of foresight – or perhaps deliberate political maneuvering – leaves the incoming administration with a fiscal gap and no immediate solutions. This move appears to be a parting gift from the outgoing government, creating challenges for their successors while absolving themselves of the responsibility.

(Un)intended Consequences

This sequence of events reveals a lack of cohesive planning and foresight in government policy. Several issues stand out:

1. Contradictory Goals: The 2023 policy aimed to increase tax revenue, while the 2025 adjustment effectively erases those gains. This contradiction suggests that political considerations outweighed fiscal responsibility.

2. Erosion of Public Trust: The abrupt shift undermines the government’s credibility. Policies enacted and then reversed without proper consultation or communication create uncertainty and confusion among taxpayers.

3. Uneven Impact: While the increased tax-free threshold benefits many citizens, it disproportionately favors company directors, who now avoid wage taxes altogether. This outcome may deepen inequality and resentment among other taxpayers.

4. Accountability of Decision-Makers: Given the significant loss of state revenue resulting from these poorly coordinated policies, there is a compelling argument that the ministers responsible should be held personally accountable. Holding public officials liable for such oversights could serve as a deterrent against future hasty or ill-considered policy decisions.

Final Thoughts

The 2025 policy adjustment, whether intentionally disruptive or simply shortsighted, highlights the importance of thoughtful governance. Tax laws are complex, and changes should be made with a comprehensive understanding of their ripple effects. When policies are poorly thought out, they risk undermining their objectives and damaging public trust. As we move forward, we must prioritize fairness and foresight in crafting tax reforms that genuinely serve the public good.

See you next week, and don’t forget to visit www.lincolngomez.com for more insights and discussions.