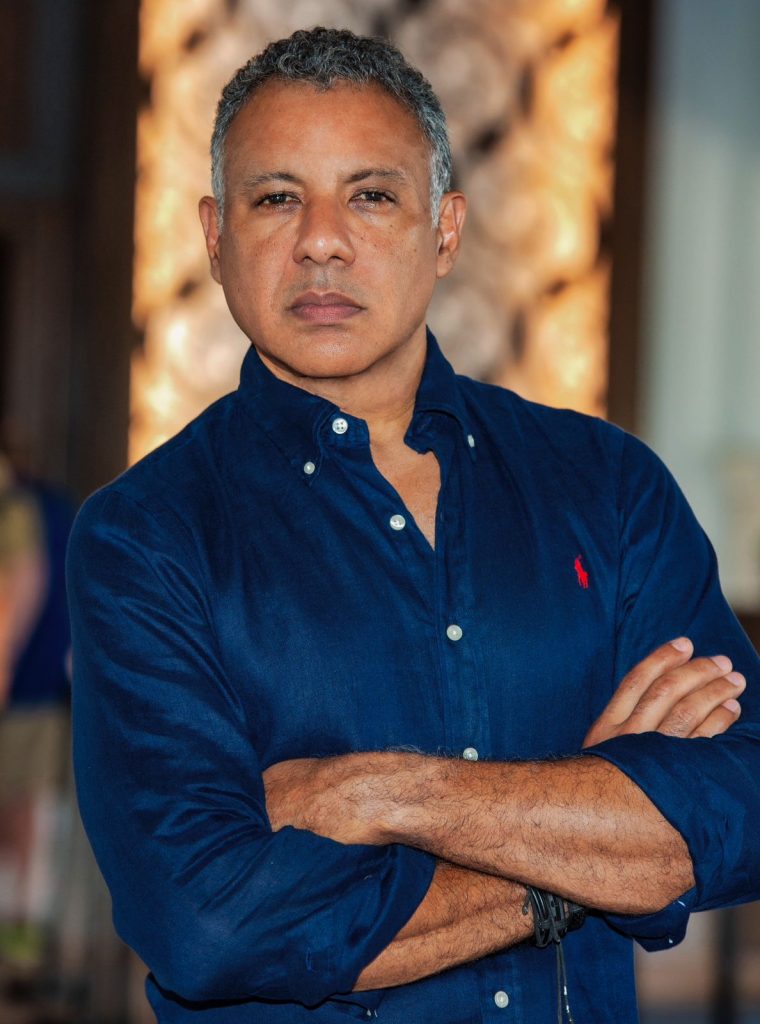

Aruba’s Fiscal Challenges Continue: A Dutch Helping Hand Amidst Rising Concerns & Interest

As Aruba navigates the complexities of the global financial landscape, recent developments have brought to light both the strengths and vulnerabilities within our fiscal management. In October of last year IU wrote “6.9% Loan for Aruba, excessive? Aruba’s Interest Rates: A Historical Perspective” and “10% PLUS: Interest for Aruba is Rising but not in a Good Way”, I raised concerns about Aruba’s transition from the LIBOR to the SOFR for calculating the interest on significant foreign debts – a move that, while technically sound, in part because of the high-risk premiums – in the range of 5% – being charged to the government of Aruba, brought with it a host of potential challenges, notably higher interest rates that mirror those of credit card APRs in the U.S.

Just last week on May 24th, 2024, Moody’s Investors Service assigned a Baa3 rating to Aruba with a stable outlook, which on the surface may suggest a balanced fiscal posture. However, this rating is a precarious equilibrium, contingent on stringent fiscal discipline and the successful implementation of economic reforms. It’s an opportune moment to revisit the concerns I voiced last October and assess how they are materializing, influencing our economic outlook and necessitating a recalibrated response from our government.

Moody’s and my dad’s question

Saturday afternoon I was catching up with my dad and he mentioned the Moody’s report and asked me to explain what exactly this and past reports sas. My dad, at 84 still has a brilliant mind and a sharp pen. Numbers however have never been his strength. So I had to figure out a way to translate the finance into something more palatable. Then it hit me. I told him to think of your doctors. Aruba’s situation can be compared to a patient who has been diagnosed with a manageable but serious chronic condition. The doctors have run all the necessary tests and the results are clear, outlining exactly what needs to be done: a combination of medication, lifestyle changes, and regular check-ups. The path to better health is well-documented and advised by professionals. However, despite knowing the risks of inaction – increased complications, deteriorating health, and potentially more drastic interventions in the future – the patient continues to ignore the medical advice. The patient – just like the government – recognizes the symptoms and understands the consequences, yet they remain paralyzed, perhaps out of fear, denial, or a sense of overwhelming at the changes required. As time passes, the condition worsens, making the necessary interventions more severe and urgent. This inaction isn’t just a passive choice; it’s an active decision to prioritize short-term comfort over long-term health and stability. I think he got it and can probably explain it to his wife and friends.

Understanding the Moody’s Rating and Its Implications

Moody’s acknowledgment of Aruba’s robust institutional framework-thanks largely to (commitments to) oversight from the Netherlands – underscores a double-edged sword of dependency and stability. This external support does enhance our governance structures but also highlights a significant reliance that may deter our own fiscal self-sufficiency. Regretfully we don’t have the discipline to manage our finances responsibly. Case and point is supported by the fact that our last approved financial statements are for 2018! In essence, we have the credit rating of a 1st year college student that spends all his money under the mantra of “freedom at last” and that now is again dependent on the parents at home to pay for his “newly found freedom”, forgetting that with “freedom” also comes financial responsibility.

The economic vulnerabilities I previously discussed have only been magnified. Our heavy reliance on tourism and the limited ability to absorb financial shocks due to our economic size are red flags that were once again flagged in Moody’s report. In October, the minister of Finance went so far as to send out a press release to the media rejecting the findings in my column. Today she seems to embrace the Moody’s report along with the red flags. These are not just theoretical concerns; they are real challenges that affect our national economic resilience.

The High Cost of Inaction

The transition to SOFR and a lousy credit rating by the lenders, as I analyzed last year, has brought about a steep increase in interest obligations – double-digit to be exact – now explicitly reflected in Moody’s anticipation of high-interest payments relative to government revenue. This situation has not emerged overnight but is a consequence of cumulative years of fiscal policy decisions that now require urgent rectification. The government’s current approach, while commendable in its intent to achieve fiscal surpluses and reduce debt levels, lacks the aggressive drive needed to overhaul our economic structures. Some surplus is even questionable because you can’t boast an Afl. 200M surplus, if you turn around and spend AFL. 100M of that in payroll adjustments for the civil servants. At the same time the government leaves sewage water and waste management unfunded. Moody’s projections and the current fiscal strategies suggest an improvement trajectory that, while positive, is in my opinion a bit too gradual and fraught with potential setbacks.

Recent Government Moves and Fiscal Implications

In a recent shocking move, the government and public unions agreed on an 11.7% pay increase for civil servants, termed a “purchase power adjustment.” This decision has almost immediately consumed half of the AFL. 200 million surplus with a stroke of the pen, illustrating a dramatic weakening of our financial stance. Not only does this raise echo my past concerns about fiscal mismanagement, but it also highlights a persistent gap between governmental promises and actions, especially concerning commitments made to the Dutch government to reduce governmental payroll expenses.

New Developments in Fiscal Oversight

Last Friday marked a significant turning point as the Dutch and Aruba governments announced that they had finally reached a consensus on introducing Dutch supervision over Aruba’s finances through a protocol to be ratified by a Kingdom Act. This move, seemingly delayed by Aruba under the guise of ‘negotiations,’ ultimately demonstrates a material concession to Dutch pressure to comply with previous commitments.” Commitments that the Prime Minister and the parliament” initially agreed to but later resisted. The recent failure of the Finance Minister to secure loans of a mere US$100M (to cover payroll for Q3 & Q4 of 2024) is indicative that the government could no longer survive without backing from the Dutch government. Without a Dutch countersign Aruba can not borrow money on the international market. This contrasts with the countless allegations by the Minister of Finance and the Prime Minister that foreign lenders have confidence in their government. This development reflects a fiscal desperation and underscores the dire need for transparent and accountable governance.

Good news

The good news for Aruba and ‘we the people’ is that, because of this upcoming oversight, we soon will have a reduced interest burden and what, we hope, will be robust oversight that can guide us to real progress and not mere fictitious fiscal discipline. The not-so-good news for politicians is that they will have to learn to govern under supervision and be subject to scrutiny by the Dutch government and its designated experts, who know our politicians like the back of their hands.

The Path Forward: Economic Diversification and Transparent Governance

What Aruba requires now is not incremental changes but bold, transformative economic policies that can diversify our economic base beyond tourism. This involves enhancing existing sectors and investing in new industries that can provide stable and sustainable revenue streams. Reality is that for decades, no government has been able to stimulate diversification and attract (foreign) investments in the non-hotel sector. Additionally, the lack of proactive communication from our government, as highlighted in my previous discussions, remains a critical gap. Transparency in how we manage our debts, engage with international financial standards, and implement reforms is not just administrative—it’s a cornerstone of public trust and confidence. I can’t say that I am optimistic about the government implementing ‘bold transformative economic policies’. Not only because of the historical record of inability, but also because elections are a mere 15 months away. The focus of the government and the members of parliament will be solely guided to become re-elected. The greater good will have to be put on hold until the ballots are counted.

Conclusion

The stable outlook from Moody’s should not be a cause for complacency but a clarion call for action. We are at a critical juncture where the choices we make today will determine the financial health of future generations. As a country, we must demand more from our leaders in terms of fiscal transparency, accountability, and innovation in economic policy. It is imperative that our government takes decisive steps to address these longstanding issues with the urgency they deserve. Only then can we ensure a stable, prosperous economic future for Aruba that is not tethered to the uncertainties of global tourism trends or the fluctuations of international interest rates. I am committed to bringing these issues to the forefront, ensuring that “we the people” are informed and engaged in the dialogue that shapes our nation’s future. Let’s not wait for the next fiscal assessment or actual Dutch supervision to take action.

#ArubaEconomy #FiscalReform #EconomicGovernance #DebtManagement#TourismEconomy#FinancialOversight#EconomicPolicy #GovernmentAccountability #DutchSupervision #ArubaFinancialCrisis